The Harp and Crown Credit Union provides safe, secure, flexible financial services for the wider police family in Northern Ireland.

“Building brighter futures through confidence with numbers.” It’s National Numeracy Day on 17th May!

A gentle reminder our next office closure dates will be on Wednesday 12th July and Thursday 13th July.

Martin contacted us to request a transfer of funds from his savings account - funds were transferred to his nominated bank account that same day!

It’s National Make a Difference to Children Month in July.

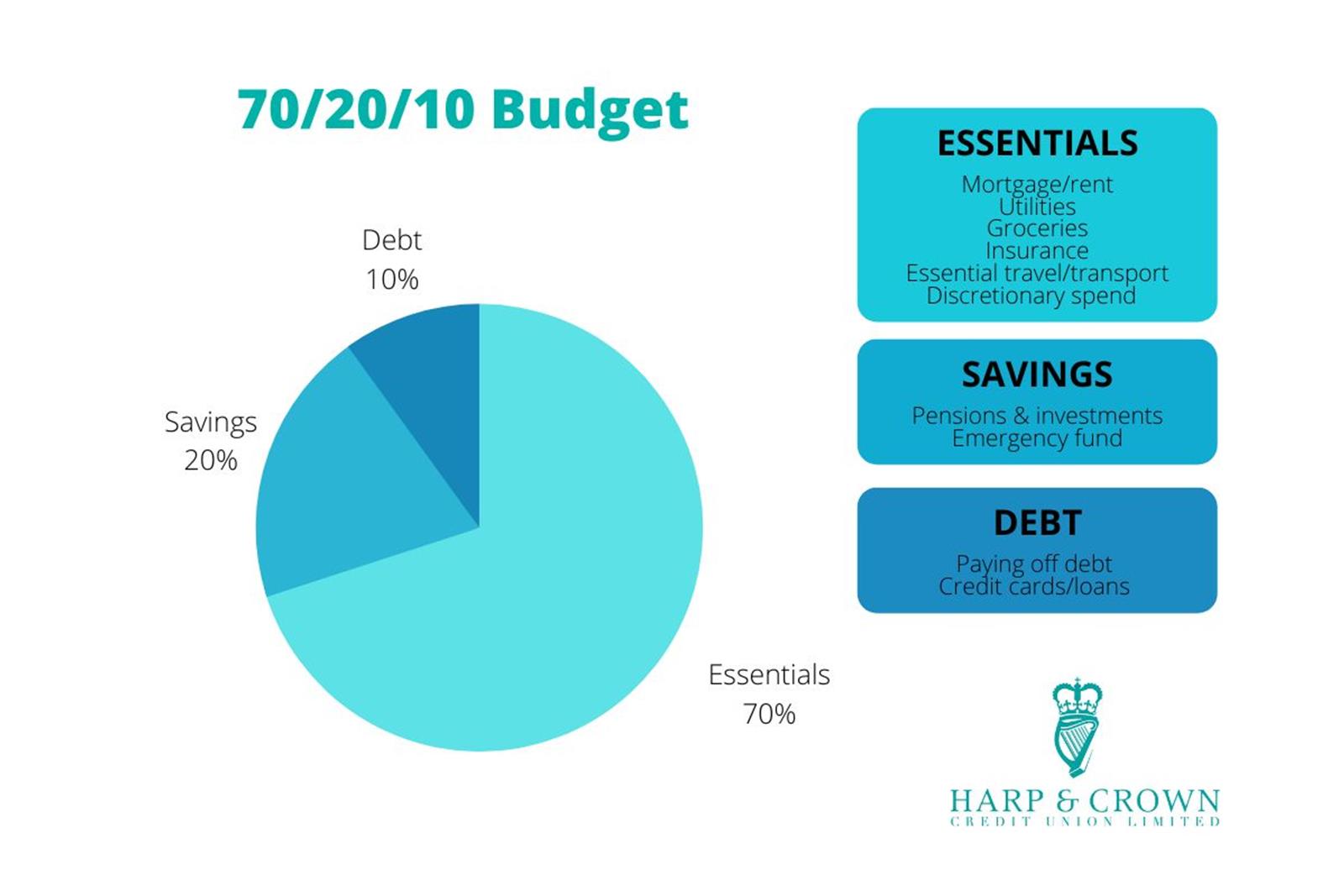

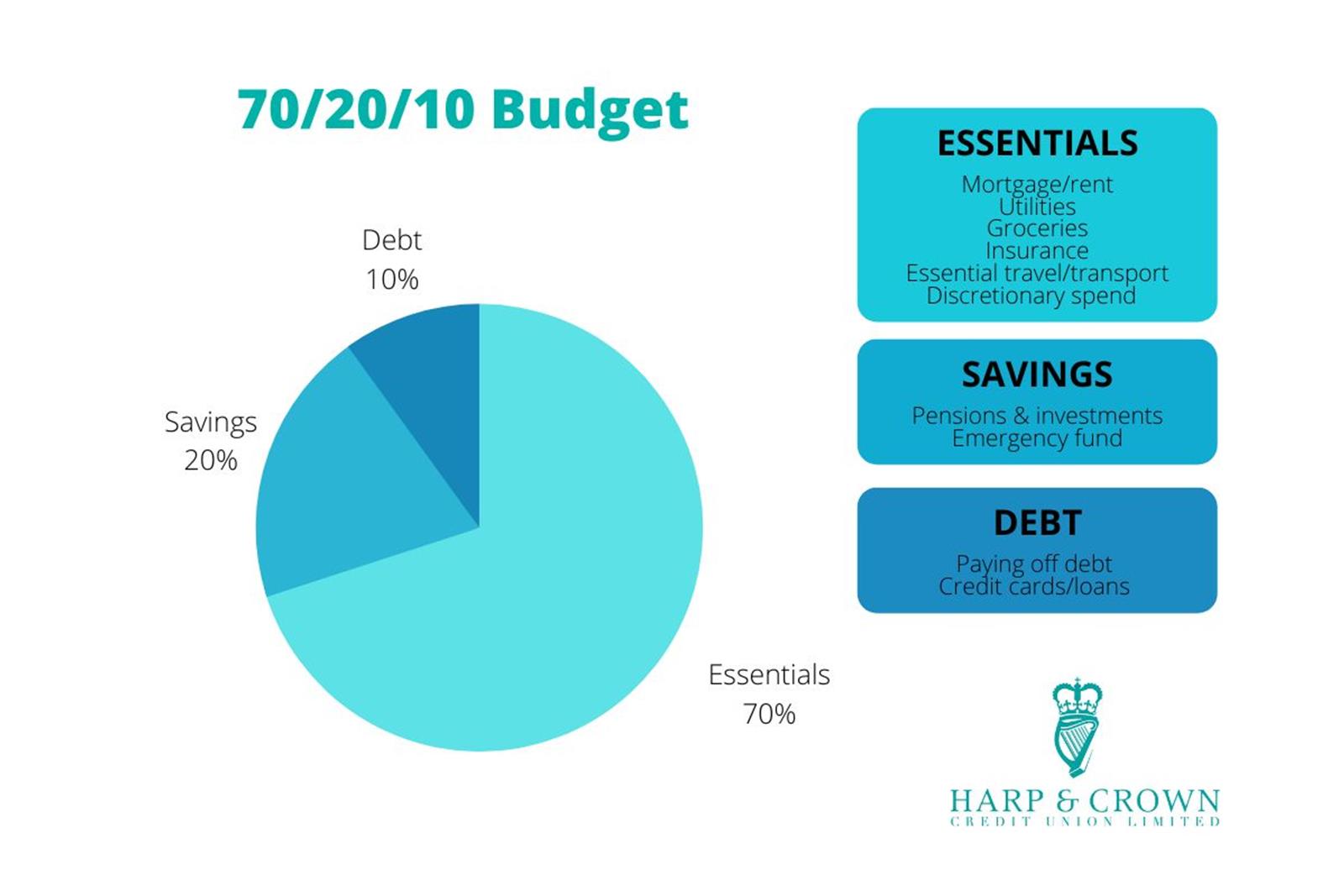

Are you living within your means? Or are you trying to "keep up with the Joneses"??

In the event of your death, your BENEFICIARY will take sole responsibility of your Harp and Crown Credit Union account.

Did you know? In 2022, we paid out a grand total DIVIDEND of £470,380 to Harp & Crown Credit Union members!

A gentle reminder our next office closure will be on Monday 28th August for the Bank Holiday.

It’s Junior Savers Week! As we near the end of our financial year (Sept-Oct) we are delighted to confirm we have around 10% more JUNIOR ACCOUNTS opened compared to last year!

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Autumn/winter season can be a hard time for everyone with heating costs, cost-of-living increases and with Christmas approaching. Here are a few ways you can manage and save on some costs this winter.

Need something to do with the kids/grandkids this very wet Mid term break?

It's Talk Money Week. Let's talk about some FACTS and YOUR Harp and Crown Credit Union account. Members did you know?

In 2023 we paid out a grand total DIVIDEND of £892,000 to Harp & Crown Credit Union members!

We paid out almost £90,000 to Harp and Crown CU members’ LOVED ONES in 2023.

Did you know? Once YOUR Junior turns 16 years, their account becomes a regular savings account?

As a serving member of the PSNI, we can organise your savings deposit to come straight from your monthly payroll.

What are YOUR plans in 2024? Whether they're big or small projects, just think of what you could save or borrow by putting a little extra into your CREDIT UNION account each month!

When you open an account with Harp and Crown Credit Union, you name a "Beneficiary". In the event of your death, your BENEFICIARY could RECEIVE up to a max £5K on TOP of YOUR SAVINGS.

Following our AGM in December, we announced an INCREASE in the Harp and Crown Credit Union member share holdings (savings limit).

GREAT NEWS! Our January 2024 figures show we have around 16% more JUNIOR Savers at the Harp and Crown Credit Union compared to January last year!

Are you RETIRING this year? Not sure what to do with your COMMUTATION payment?

A gentle reminder...our next office closure is coming up soon - Monday 18th March 2024 (St Patrick's Day closure).

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Need help with New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Are you RETIRING this year? Not sure what to do with your COMMUTATION payment?

In the event of your death, your BENEFICIARY could RECEIVE up to a max £5K on TOP of YOUR SAVINGS. Are YOUR BENEFICIARY details UP TO DATE?

I’m a Harp and Crown Credit Union member. Which of my family members can join?

Do you have young children you could be SAVING for? With the kids off school for the Easter break, why not start NOW and help plan a healthier financial future for them!

Did you know? Once YOUR Junior turns 16 years, their account becomes a regular savings account?

Are they planning their FIRST CAR PURCHASE?

Perhaps they NEED a CAR for college or university? Or work?

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

I’m a Harp and Crown Credit Union member. Which of my family members can join?

Need help with New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Do you have young children you could be SAVING for? Why not start NOW and help plan a healthier financial future for them!

In the event of your death, your BENEFICIARY could RECEIVE up to a max £5K on TOP of YOUR SAVINGS. Are YOUR BENEFICIARY details UP TO DATE?

Did you know? Once YOUR Junior turns 16 years, their account becomes a regular savings account?

Please note the Harp and Crown office will be closed on May Bank Holiday Monday 6th May.

Do you have young children you could be SAVING for? Helping plan a healthier financial future for them?

In the event of your death, your BENEFICIARY could RECEIVE up to a max £5K on TOP of YOUR SAVINGS. Are YOUR BENEFICIARY details UP TO DATE?

I’m a Harp and Crown Credit Union member. Which of my family members can join?