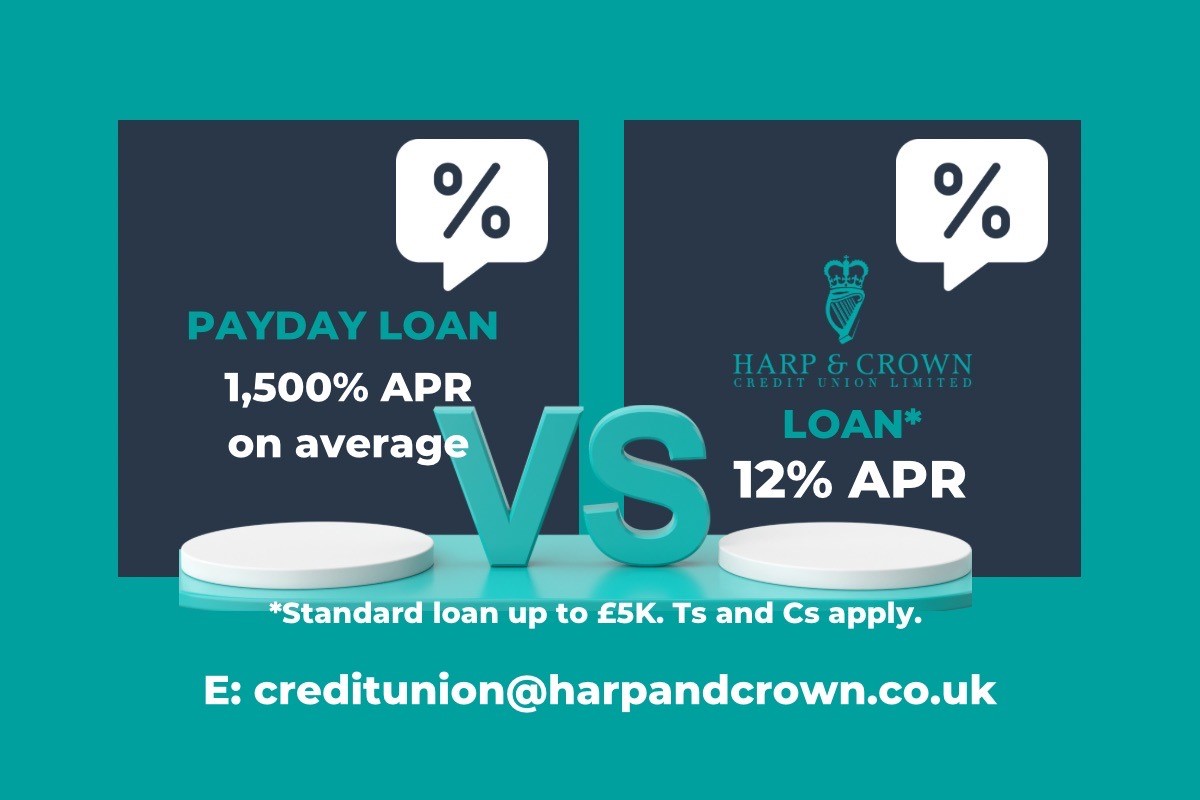

Do you need some financial help before pay day? Payday loans may be tempting in a time of financial need but please be aware of high interest rates and the risk of getting into long term debt!

Are you a new member (a member for less than 6 months) and/or haven’t taken out a loan with us yet?

Ben applied for a FIRST TIME LOAN to purchase a car, enjoying our lower interest rate of 5.5% APR!

We’re half way through our Summer Loan Promotion (one week to go)! So far we've helped.....

Continuing our support of Mental Health Awareness Week…One of our members approached us recently to apply for a loan but hadn’t declared all outgoings.

Ray qualified for our Summer Loan Promotion, TOPPING UP his existing loan with us.

Another great day…for some DIY! Perfect for enjoying your garden...maybe it need a revamp for the summer? Need some help?

Do you know how much is remaining on your loan with us? Remember our 5 x savings Vs borrowing benefit!

WOW! In May during our Summer Loan Promotion we can confirm the following figures:

We have been spoiled with this great weather! But it’s not set to last! Time to book your next sun holiday!

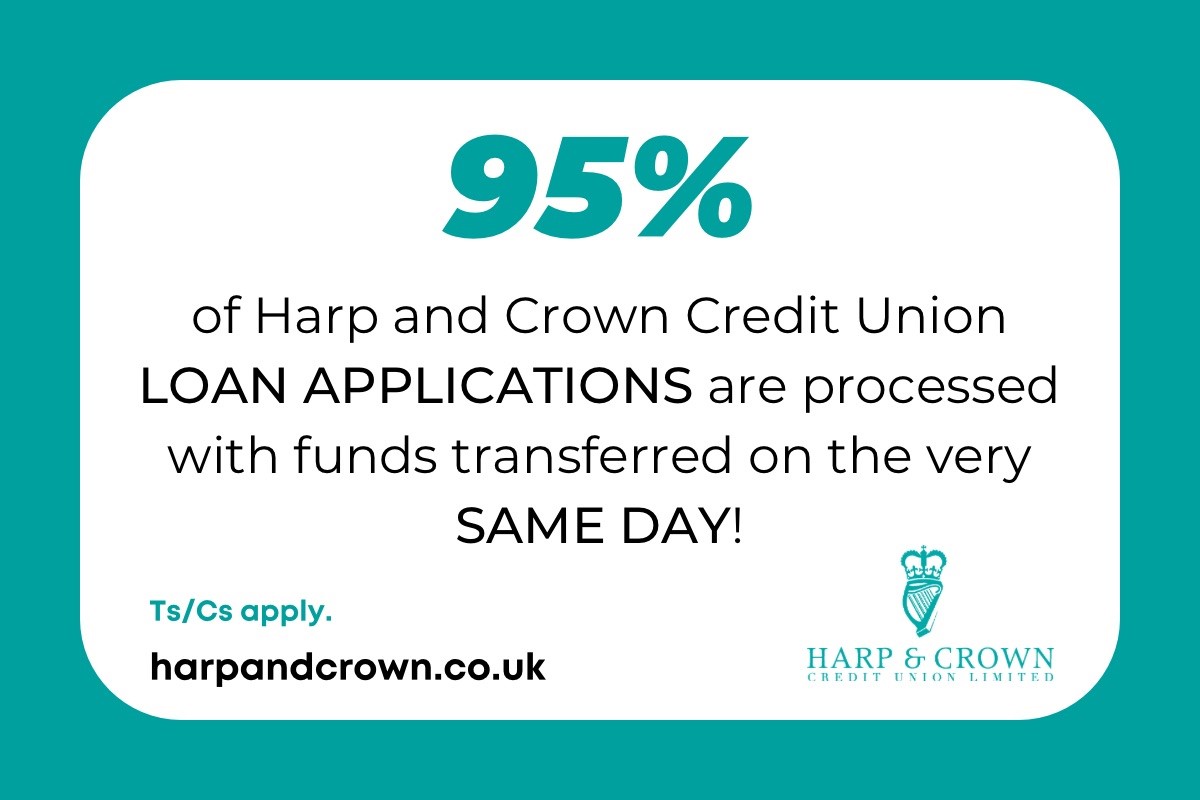

Marion requested a TOP UP of her existing loan. This was actioned and funds were transferred to her nominated bank account, all on the same day!

A huge welcome to our new members! Thank you for choosing us as your Number ONE credit union!

We were delighted to help one of our members this week who was struggling with unmanageable debt.

Paul wanted to apply for a new loan and had queried paying off his existing loan balance with his Harp and Crown CU savings.

Need help financing a holiday, car, home improvement, credit card debt and more?

With the recent news of “car loans charges doubling” we’ve seen more of our members coming forward to apply for one of our lower interest loans!

Have you seen a large increase in your credit card or loan interest? Do you have several high interest loans/credit cards to pay off?

Harp and Crown CU members! Please be assured our LOANS remain at the SAME lower interest rates!

Do you know how much is remaining on your loan with us? Need some help with forthcoming holiday costs?

Apart from ONE great reason alone…the increase in Bank of England rates…and our lower interest rates remaining the same…here's why you should visit your credit union FIRST before approaching a bank for a loan.

Need help financing a holiday, car, home improvement, credit card debt and more? And in an ethical, flexible and affordable way?

Need a TOP UP to help before payday or to pay unexpected bills this month?? AVOID high interest payday loans and come to us first!

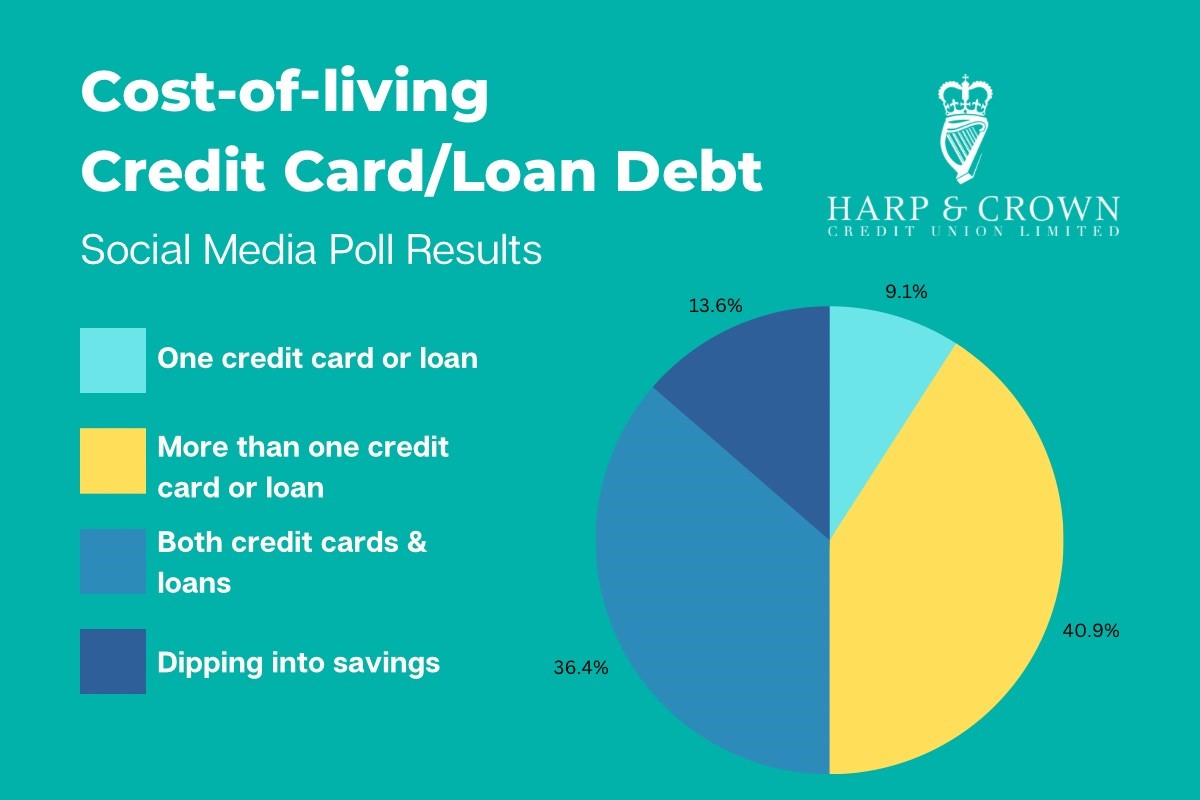

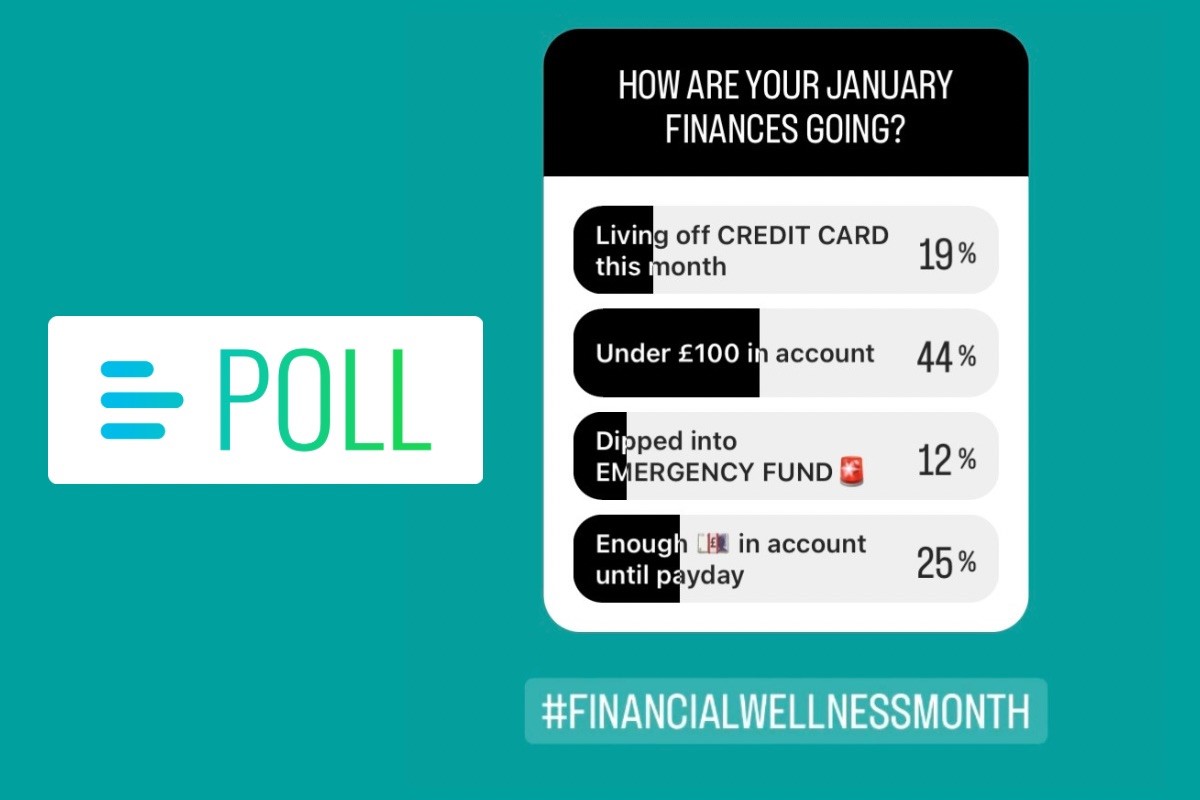

The continued HIGH cost-of-living is continuing to create financial stress for many. We conducted a Social Media POLL asking YOU if you’re paying off any credit cards or loans…

We HELPED a member with several HIGH INTEREST credit cards (one as high as 26% APR)…

Need a TOP UP to help before payday or to pay unexpected bills this month? Get in touch before the Bank Holiday weekend!

According to our Member Survey, over 25% of you took out loans for HOME IMPROVEMENT...

Credit Unions are VERY on topic at the moment with the departure of several major banks in Ireland, and credit unions coming to the fore in excellence.

Need a TOP UP to help before payday or to pay unexpected bills this month??

Could a loan help you this Christmas? YOU may be eligible** for our loan promotion up to the value of £5,000! NO application form required.

Greg was able to TOP UP his existing loan, with funds being transferred on the same day as his application.

Nigel took advantage of our Christmas Loan Promotion yesterday and is now entered into our £500 prize draw!

With just under 6 weeks until Christmas...Alistair took advantage of our Christmas Loan Promotion yesterday and is now entered into our £500 prize draw!

FINA DAY… of our Christmas Loan Promotion! Have you applied for YOUR loan yet? If eligible** you could apply for a loan up to the value of £5,000! NO application form required.

Are your CREDIT CARD bills soaring? With the potential to get worse through added expenses and the cost-of-living on the lead up to Christmas…

NEED some extra funds coming up to Christmas? BUT don’t want to withdraw more of your SAVINGS?

Are your CREDIT CARD bills soaring? With the potential to get worse on the lead up to Christmas…

In 2023, we paid out a total of £76,000 in LOAN INTEREST REBATE to our borrowers!

We’ll always try our best to HELP YOU reduce any high interest debt and STOP you sinking into further debt.

Around 95% of our CREDIT UNION LOAN applications are approved and issued on the same day.

Changing your car soon? Not sure whether to buy NEW, second hand or go down the HP or PCP route?

Harp and Crown Credit Union member Jenny applied for a FIRST TIME LOAN at our competitive interest rate of 5.5% APR.

Our recent member survey shows that 27% of Harp & Crown CU members who BORROW do so for HOME IMPROVEMENT reasons!

Need to cover the cost of a new car or emergency car repairs? Home Improvement? A well earned holiday. Or perhaps you or a loved one have forthcoming wedding costs to manage?

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

Inflation, the rate at which prices rise over time, has been slowly falling. In October 2022 the UK hit its highest rate in 40 years at 11.1%.

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Hands up who got caught out with the BANK’S “HEADLINE” loan rate…

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Need help with New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Our recent member survey shows that 21% of Harp & Crown CU members who BORROW do so for HOME IMPROVEMENT reasons!