SUB MENU

Annual Rebate

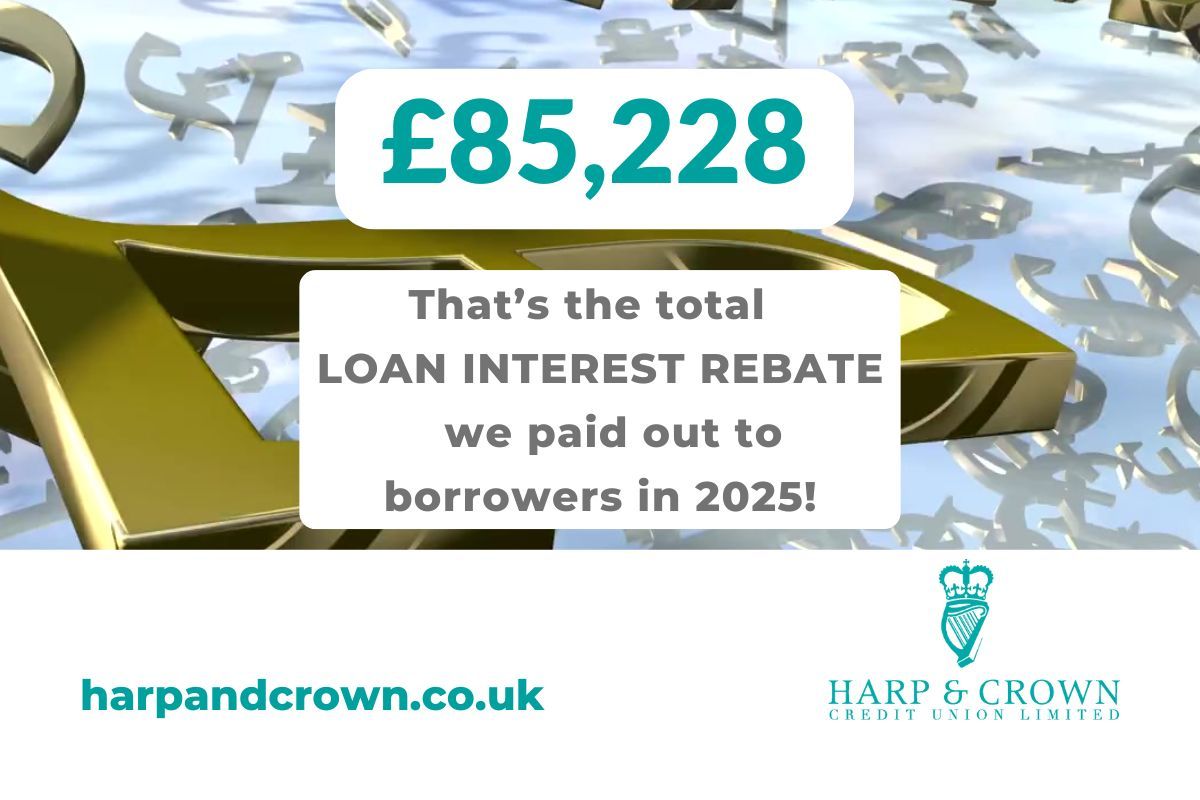

An annual rebate may be paid annually to all borrowers at the end of the financial year, where applicable.

What does this mean for YOU as a saver and borrower at Harp and Crown Credit Union?

Unlike most banks and credit lenders we GIVE BACK MORE to our members. In 2025 we gave back in the form of:

Harp and Crown v Bank?

COMPARATIVE EXAMPLE: HARP AND CROWN CREDIT UNION (HACCU) MEMBER WITH £5,000 SHARES, BORROWING £25,000

HACCU |

Santander |

|

Instant Access Savings |

£5,000 | £5,000 |

Loan Amount |

£25,000 | £25,000 |

Loan APR |

6.9% FIXED | 5.9% - 29.9% VARIABLE |

Maximum Loan Interest Payable (over 5 years) |

£4,631.08 (6.9%) | £20,308.40 (29.9%) |

Loan Rebate (1 year example*) |

£103 | - |

Dividend vs Bank Interest (1 year) |

£150 (3%) | £100 (2% - Easy Access Saver) |

Life Cover |

FREE up to age 70 | From £5 per month |

Early Settlement Fees/Share Withdrawal |

NO FEES EVER | Possible charges |

Total Member Return (1 year example*) |

£253 + Free Life Cover | £100 (minus cover/higher interest) |

*Please note this is a specific HACCU member example as of December 2025. The dividend and loan rebate figures are subject to shares held, loan product taken and loan period. Ts/Cs apply.

CONTACT US TODAY

Contact us today with any questions you may have.

E: creditunion@harpandcrown.co.uk

The Harp and Crown Credit Union has been providing safe, ethical and flexible finances for the Police and wider Police family in Northern Ireland since 1998.