And in an ethical, flexible and affordable way?

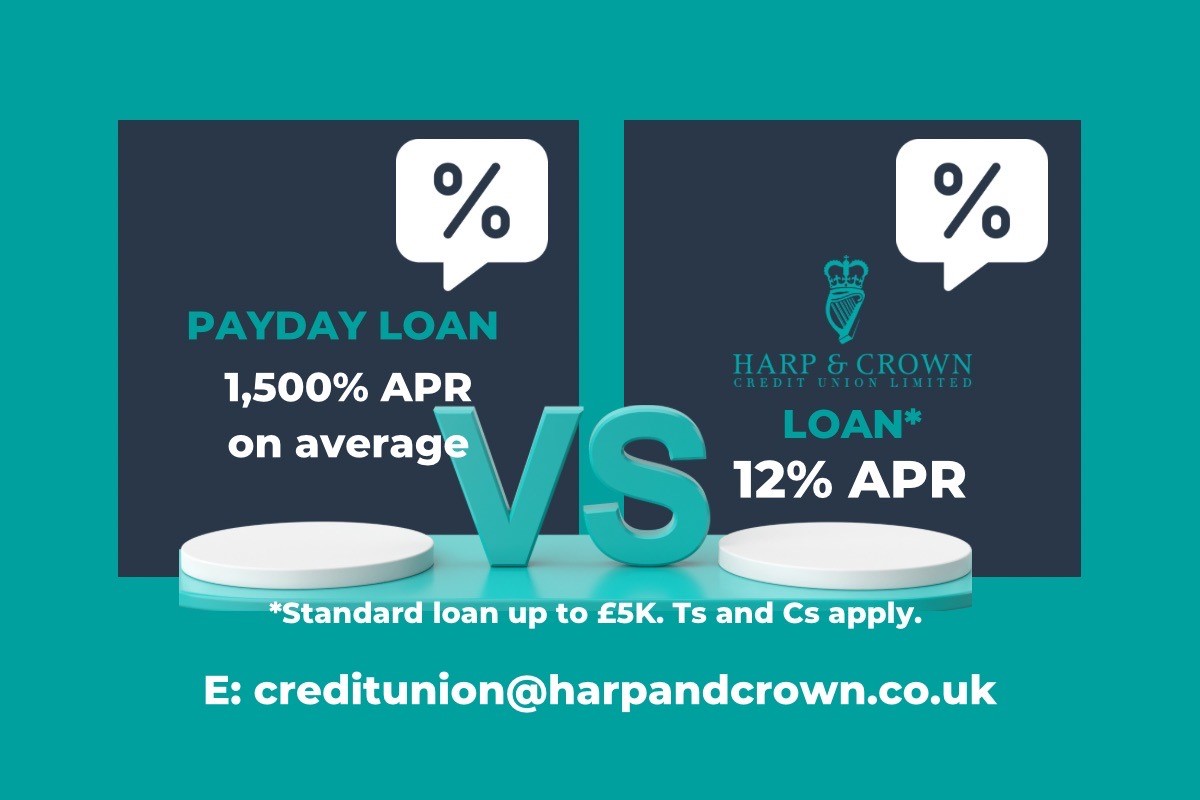

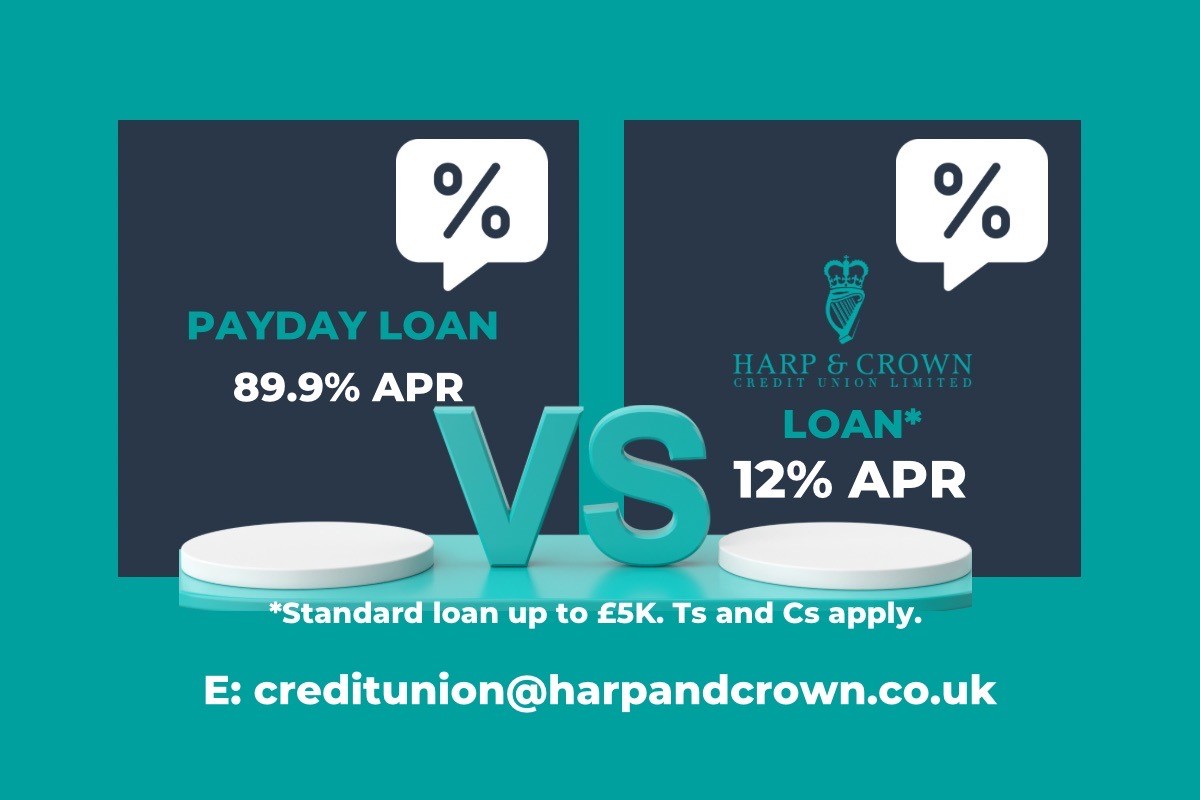

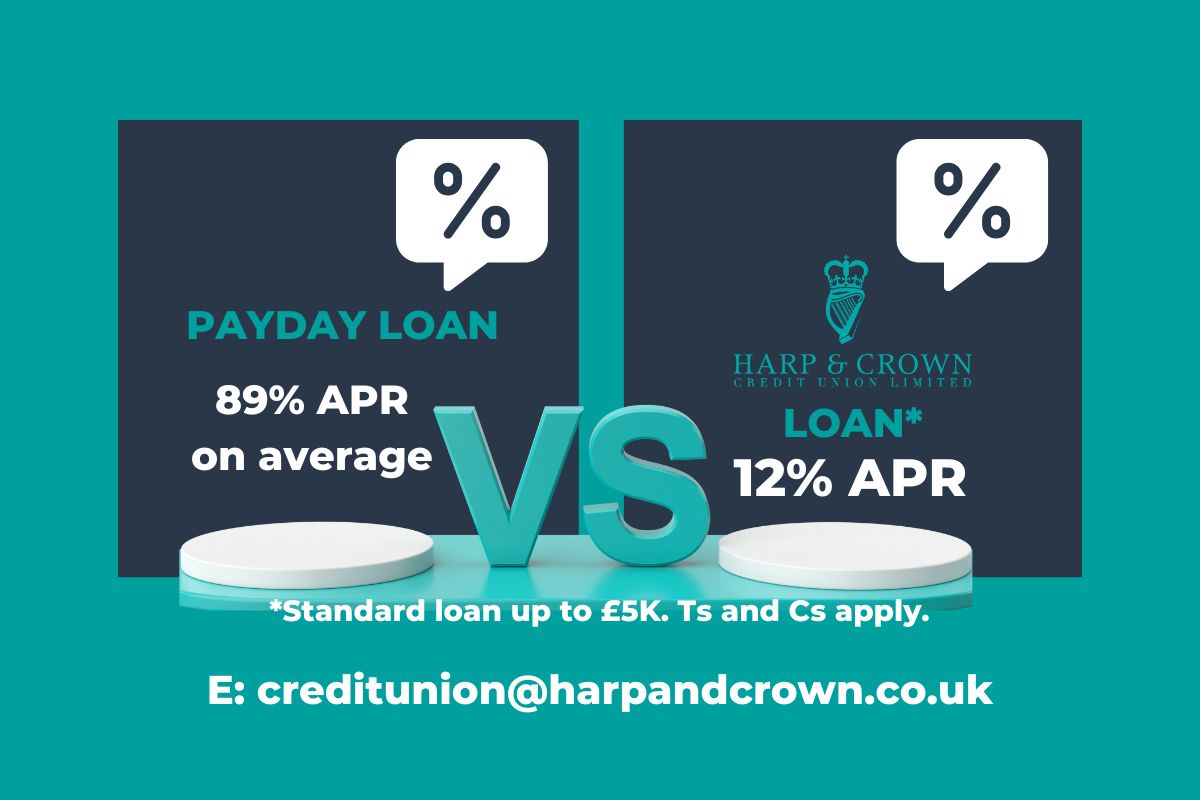

Do you need some financial help before pay day? Payday loans may be tempting in a time of financial need but please be aware of high interest rates and the risk of getting into long term debt!

Considering our Summer Loan Promotion? Here are 10 reasons why you should visit your credit union first, before approaching a bank for a loan…

Are you a new member (a member for less than 6 months) and/or haven’t taken out a loan with us yet?

Ben applied for a FIRST TIME LOAN to purchase a car, enjoying our lower interest rate of 5.5% APR!

We’re half way through our Summer Loan Promotion (one week to go)! So far we've helped.....

Continuing our support of Mental Health Awareness Week…One of our members approached us recently to apply for a loan but hadn’t declared all outgoings.

Ray qualified for our Summer Loan Promotion, TOPPING UP his existing loan with us.

Another great day…for some DIY! Perfect for enjoying your garden...maybe it need a revamp for the summer? Need some help?

Do you know how much is remaining on your loan with us? Remember our 5 x savings Vs borrowing benefit!

WOW! In May during our Summer Loan Promotion we can confirm the following figures:

We have been spoiled with this great weather! But it’s not set to last! Time to book your next sun holiday!

Marion requested a TOP UP of her existing loan. This was actioned and funds were transferred to her nominated bank account, all on the same day!

A huge welcome to our new members! Thank you for choosing us as your Number ONE credit union!

We were delighted to help one of our members this week who was struggling with unmanageable debt.

A gentle reminder our next office closure dates will be on Wednesday 12th July and Thursday 13th July.

Paul wanted to apply for a new loan and had queried paying off his existing loan balance with his Harp and Crown CU savings.

Need help financing a holiday, car, home improvement, credit card debt and more?

With the recent news of “car loans charges doubling” we’ve seen more of our members coming forward to apply for one of our lower interest loans!

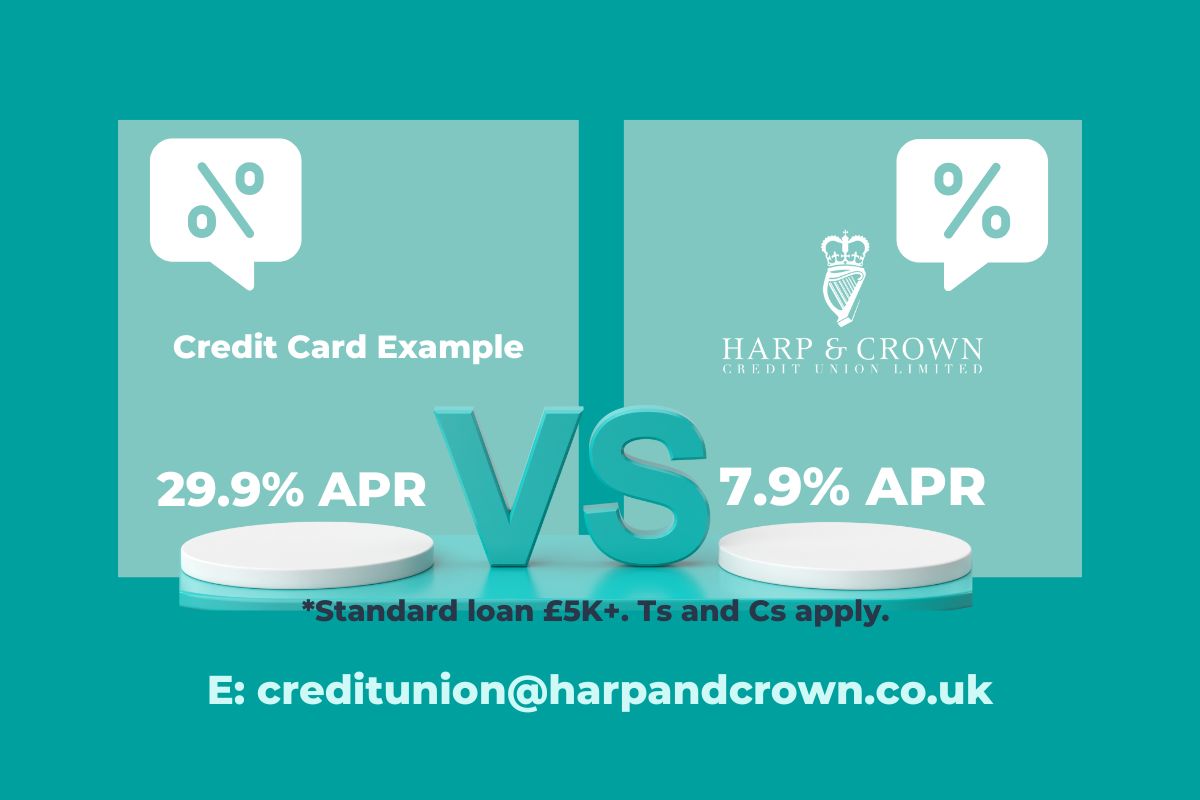

Have you seen a large increase in your credit card or loan interest? Do you have several high interest loans/credit cards to pay off?

Harp and Crown CU members! Please be assured our LOANS remain at the SAME lower interest rates!

Do you know how much is remaining on your loan with us? Need some help with forthcoming holiday costs?

Apart from ONE great reason alone…the increase in Bank of England rates…and our lower interest rates remaining the same…here's why you should visit your credit union FIRST before approaching a bank for a loan.

Need help financing a holiday, car, home improvement, credit card debt and more? And in an ethical, flexible and affordable way?

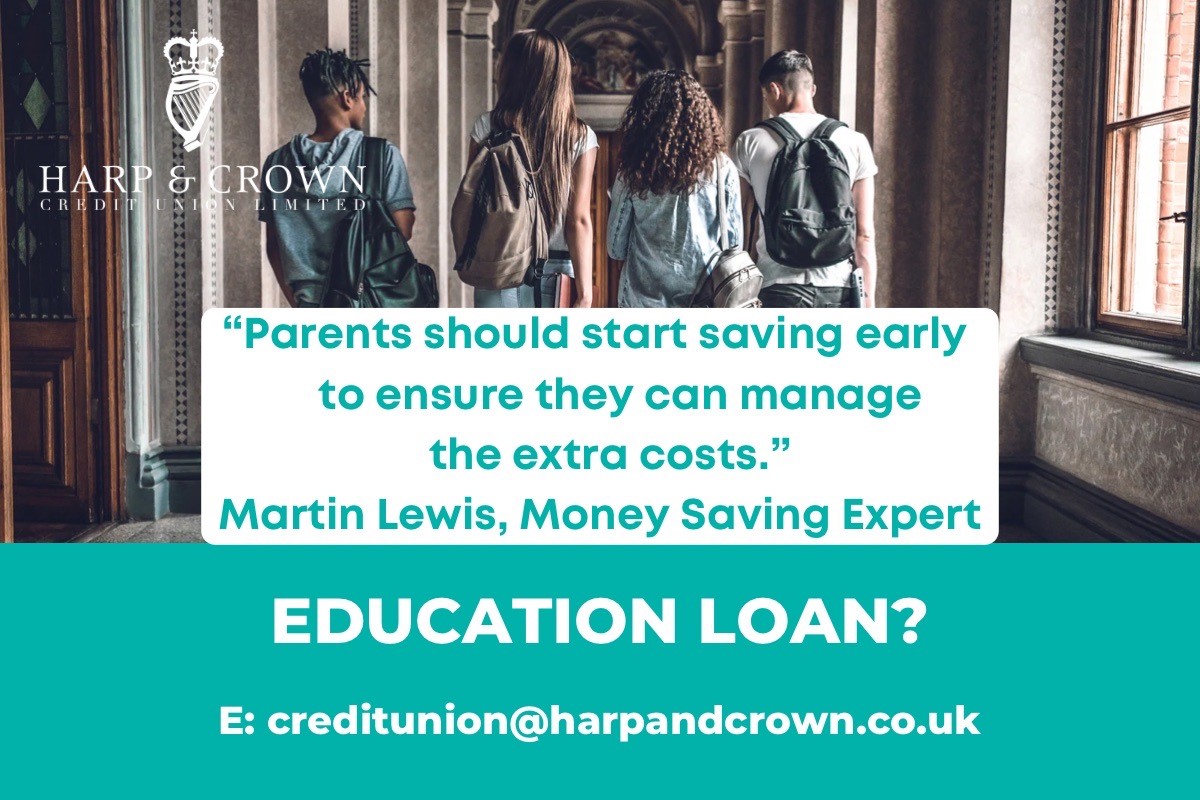

Do you have a child or more than one child heading off to college or university soon? Or perhaps you’re planning for this big event in one, two or three years’+ time. Are you ready for the financial investment which comes with your child studying away from home?

Need a TOP UP to help before payday or to pay unexpected bills this month?? AVOID high interest payday loans and come to us first!

In the event of your death, your BENEFICIARY will take sole responsibility of your Harp and Crown Credit Union account.

More and more people are moving towards a "greener" way of life, with a range of eco-friendly and sustainable products available. Some involve large investments, others a simple change in behaviour.

Are you retired or have left service? There’s no need to close your Harp and Crown Credit Union account!

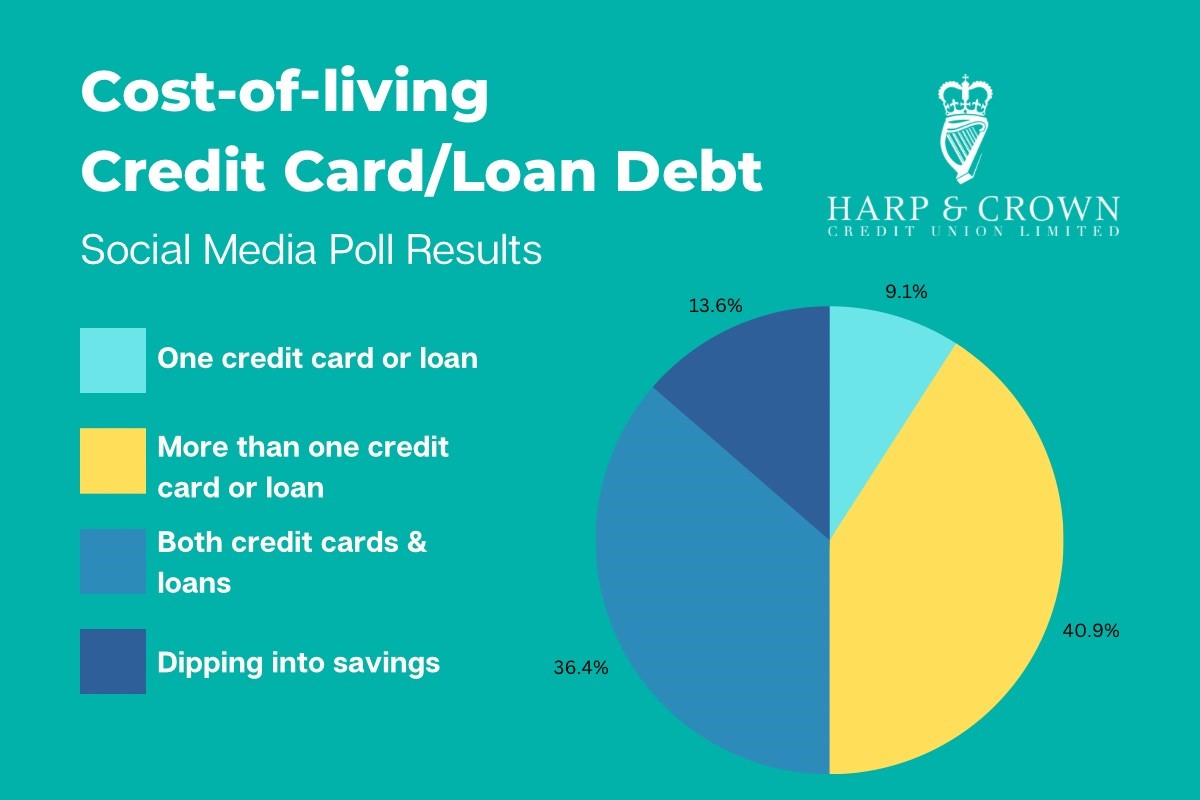

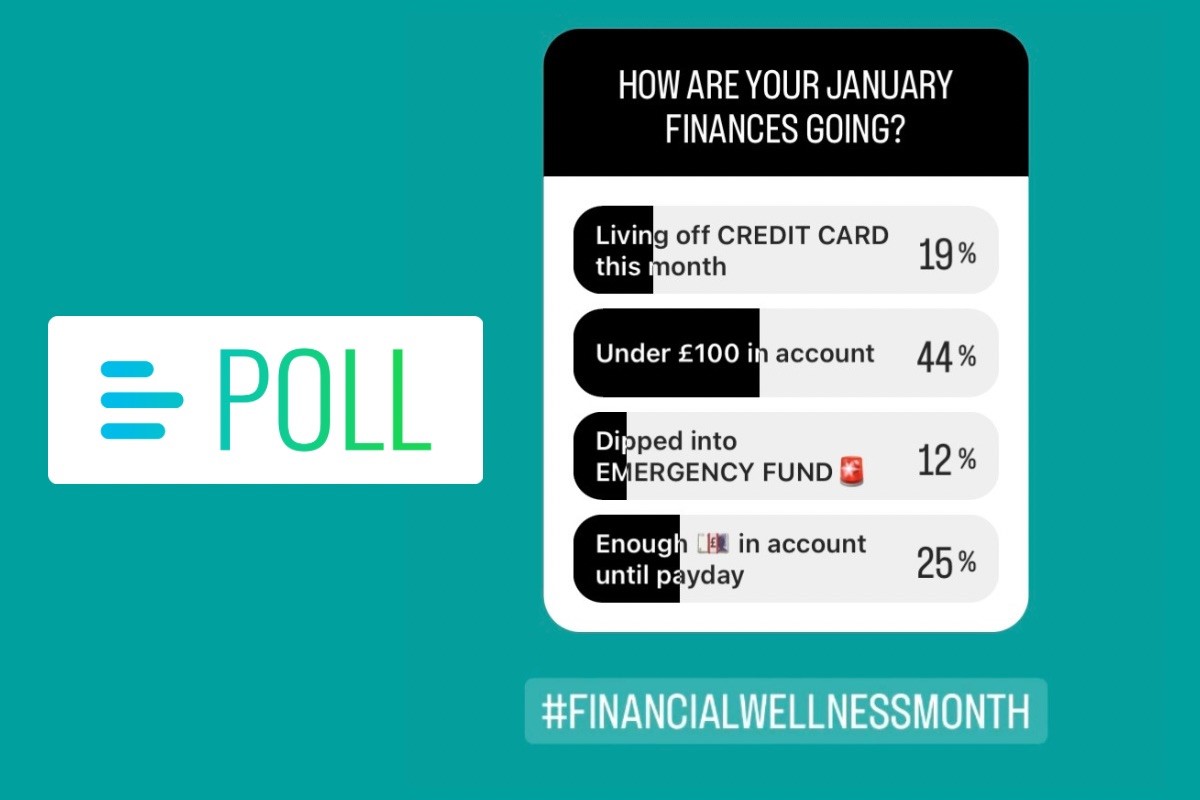

The continued HIGH cost-of-living is continuing to create financial stress for many. We conducted a Social Media POLL asking YOU if you’re paying off any credit cards or loans…

We HELPED a member with several HIGH INTEREST credit cards (one as high as 26% APR)…

Apart from ONE great reason alone…the increase in Bank of England rates…and our lower interest rates remaining the same…here's why you should visit your credit union FIRST before approaching a bank for a loan.

VERY BEST OF LUCK to all receiving their AS, A level and CoPE results this morning!

UNLIKE banks, CREDIT UNIONS such as the Harp and Crown CU provide FREE LIFE COVER up the the age of 70 years old.

Need a TOP UP to help before payday or to pay unexpected bills this month? Get in touch before the Bank Holiday weekend!

Our MEMBER SURVEY so far says 43% of you use your Harp & Crown CU account for INSTANT ACCESS and as an EMERGENCY FUND. 48% cite LOANS as the reason.

According to our Member Survey, over 25% of you took out loans for HOME IMPROVEMENT...

“If we learn nothing else from this tragedy, we learn that life is short and there is no time for hate.” Sandy Dahl

WOW! Just WOW! We received this WONDERFUL feedback from a Harp and Crown Credit Union member.

This is a friendly warning from Mr and Mrs Claus! It’s officially 100 days until CHRISTMAS!

As we near the end of our financial year (running from Oct-Sept) we’re reflecting on the BENEFITS of being a Harp and Crown Credit Union member!

It’s back to COLLEGE and UNIVERSITY season! Are YOUR FINANCES starting to FEEL THE PINCH?

It’s “wedding season”. Are YOU or a family member getting married this month? Or perhaps you’re planning for a 2024 wedding?

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

“You helped my daughter get her first car with the family membership. Thank you.” Invest in YOUR FAMILY’s financial future today!

Before asking for credit, check your credit score! You can do this online via a credit reference agency. Need to improve your credit score?

Credit Unions are VERY on topic at the moment with the departure of several major banks in Ireland, and credit unions coming to the fore in excellence.

Need a TOP UP to help before payday or to pay unexpected bills this month??

Could a loan help you this Christmas? YOU may be eligible** for our loan promotion up to the value of £5,000! NO application form required.

It’s National Stress Awareness Day and we can’t emphasise enough how important it is to reduce stress and look after your mental health and well-being. Our members fulfil various roles within the police community, all with their own stress factors.

Could a loan help you this Christmas? YOU may be eligible** for our loan promotion up to the value of £5,000! NO application form required.

Could a loan help you this Christmas? YOU may be eligible** for our loan promotion up to the value of £5,000! NO application form required.

Greg was able to TOP UP his existing loan, with funds being transferred on the same day as his application.

Nigel took advantage of our Christmas Loan Promotion yesterday and is now entered into our £500 prize draw!

Are you planning to purchase your first home? Or perhaps you have children or grandchildren who are first time home buyers? Read our latest blog on the topic here.

With just under 6 weeks until Christmas...Alistair took advantage of our Christmas Loan Promotion yesterday and is now entered into our £500 prize draw!

FINA DAY… of our Christmas Loan Promotion! Have you applied for YOUR loan yet? If eligible** you could apply for a loan up to the value of £5,000! NO application form required.

Did you request a CHRISTMAS LOAN PROMOTION quote before our 4pm deadline last Friday?

Are your CREDIT CARD bills soaring? With the potential to get worse through added expenses and the cost-of-living on the lead up to Christmas…

NEED some extra funds coming up to Christmas? BUT don’t want to withdraw more of your SAVINGS?

Are your CREDIT CARD bills soaring? With the potential to get worse on the lead up to Christmas…

Happy Christmas Eve! Are YOU or a family member planning an engagement this festive season?

In 2023, we paid out a total of £76,000 in LOAN INTEREST REBATE to our borrowers!

We’ll always try our best to HELP YOU reduce any high interest debt and STOP you sinking into further debt.

Does YOUR child aged 18+ have a Harp and Crown CU account? Are they planning their FIRST CAR PURCHASE?

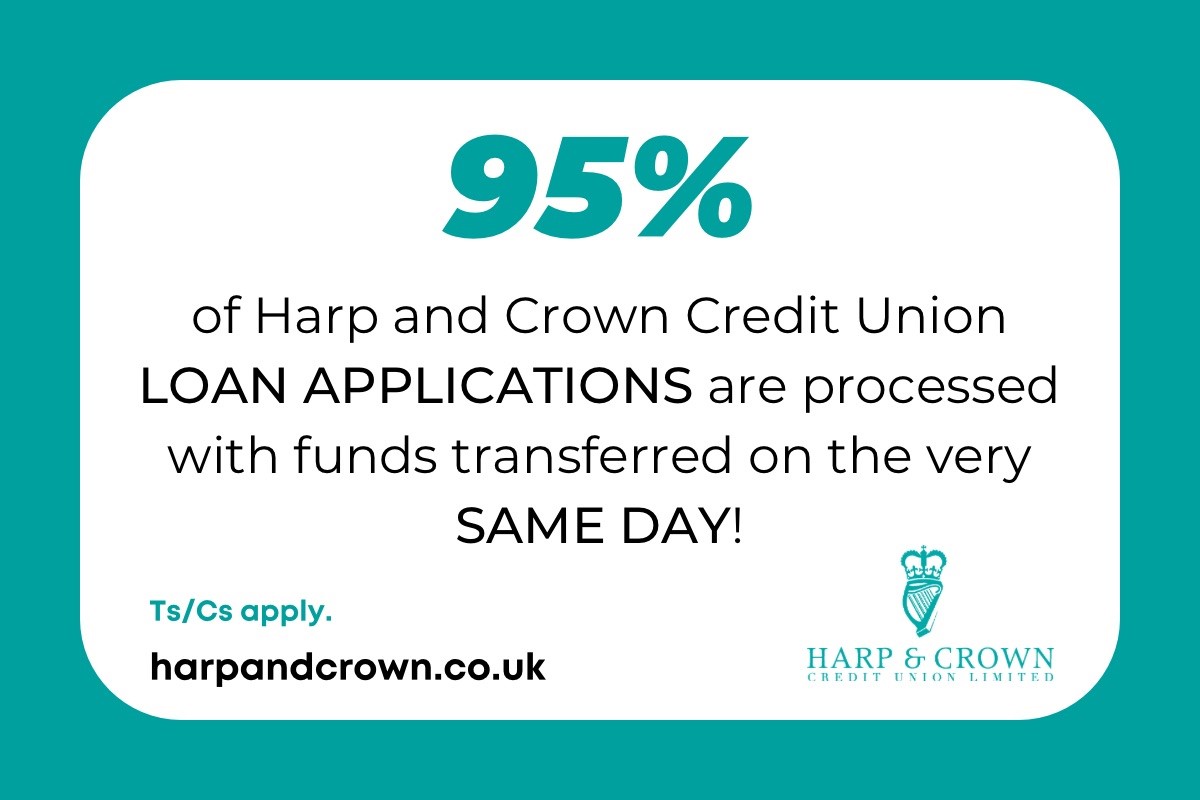

Around 95% of our CREDIT UNION LOAN applications are approved and issued on the same day.

Changing your car soon? Not sure whether to buy NEW, second hand or go down the HP or PCP route?

Did the recent storms (Storm Isha and Storm Jocelyn!) impact on your home, business and property?

What are YOUR plans in 2024? Whether they're big or small projects, just think of what you could save or borrow by putting a little extra into your CREDIT UNION account each month!

How are your New Year’s resolutions going so far in 2024? Perhaps you've started to declutter your home? But what about "financially decluttering" to stay on top of your financial wellbeing?

Harp and Crown Credit Union member Jenny applied for a FIRST TIME LOAN at our competitive interest rate of 5.5% APR.

Our recent member survey shows that 27% of Harp & Crown CU members who BORROW do so for HOME IMPROVEMENT reasons!

“POLICE FAMILY” in Northern Ireland! Why not START NOW and make 2024 the year you invest in a HEALTHIER financial future for YOU and YOUR family!

Our latest survey shows that HOLIDAYS are IMPORTANT to our members! 39% of you cited TRAVEL as one of your main interests outside of work.

Need to cover the cost of a new car or emergency car repairs? Home Improvement? A well earned holiday. Or perhaps you or a loved one have forthcoming wedding costs to manage?

Do you know how much is remaining on your loan with us? Need some help with unforeseen costs this February?

THANK YOU for this recent Member Survey feedback! And for your loyalty to the Harp and Crown Credit Union!

We absolutely LOVED visiting the Belfast Harbour Police yesterday and in such a beautiful setting!

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

Did you know some Payday loans are offering short term loans as high as 89.9% APR! Shocking!

A huge welcome to our new members! Thank you for choosing us as your No 1 credit union!

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

A gentle reminder...our next office closure is coming up soon - Monday 18th March 2024 (St Patrick's Day closure).

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Need help with New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Are you RETIRING this year? Not sure what to do with your COMMUTATION payment?

In the event of your death, your BENEFICIARY could RECEIVE up to a max £5K on TOP of YOUR SAVINGS. Are YOUR BENEFICIARY details UP TO DATE?

Sean had his “home improvement loan” application approved and funds transferred to his account…all on the same day!

Marion applied for a “TOP UP” of her loan. Her application was approved and funds transferred to her account…all on the same day!

Are they planning their FIRST CAR PURCHASE?

Perhaps they NEED a CAR for college or university? Or work?

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Some highlights from our recent visits to police stations & police family organisations across Northern Ireland!

Are they planning their FIRST CAR PURCHASE? Perhaps they NEED a CAR for college or university? Or work?

Need help with New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

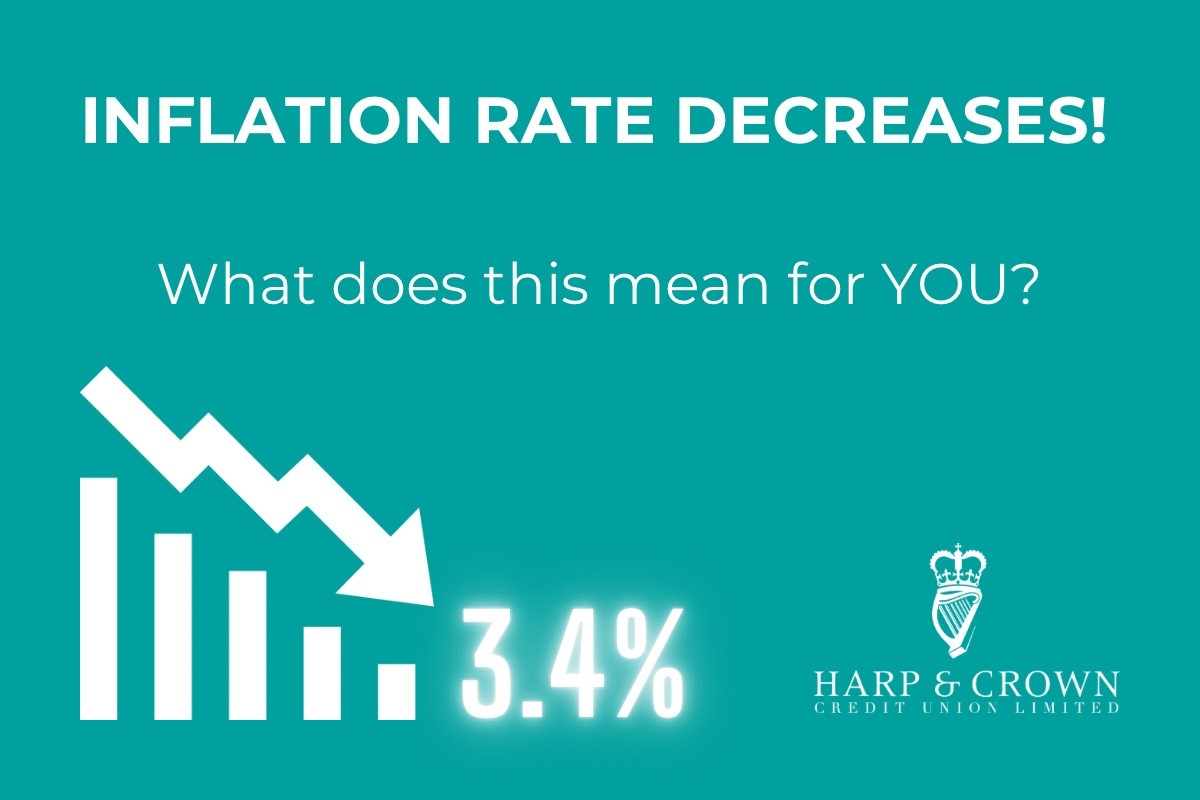

Inflation, the rate at which prices rise over time, has been slowly falling. In October 2022 the UK hit its highest rate in 40 years at 11.1%.

Do you have a furry friend in the family? April is National Pet Month which aims to encourage people to look after their pets responsibly while also highlighting the benefits of pets in people’s lives. But how much does it all cost you?

.jpg)

Our latest survey showed us that TRAVEL is IMPORTANT to our members! 39% of you cited TRAVEL as one of your main interests! Here’s what you need to know if you’re planning a trip this year and how YOUR Credit Union can help you get there!

.jpg)

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

There are MANY reasons to choose your credit union over a bank, whether that’s to avail of lower interest, ethical loans, save into an instant access emergency fund or the desire to belong to a community of likeminded savers and borrowers.

Are you RETIRING this year? Not sure what to do with your COMMUTATION payment?

Need help with New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Need help with a Private Health Procedure, New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Need help financing a holiday, car, home improvement, credit card debt and more?

And in an ethical, flexible and affordable way?

Do you know how much is remaining on your loan with us? Need some help with forthcoming holiday costs?

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Another happy Harp and Crown CU member walking away with a lower interest CREDIT UNION LOAN!

For all of us in the Northern Hemisphere, the Summer Solstice occurs on the 20th June 2024.

The Harp and Crown Credit Union office will be closed on Friday 12th and Monday 15th July for the Bank Holiday.

“How can I make a LODGEMENT?” “AND what is the MAXIMUM deposit I can make per calendar month?”

We are closed today for the July Bank Holiday but will reopen again Tuesday at 9am.

In the event of your death, your BENEFICIARY could RECEIVE up to a max £5K on TOP of YOUR SAVINGS. Are YOUR BENEFICIARY details UP TO DATE?

“How can I make a LODGEMENT?” “AND what is the MAXIMUM deposit I can make per calendar month?”

Need help financing a holiday, car, home improvement, credit card debt and more?

And in an ethical, flexible and affordable way?

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

Bob applied for a loan and his application was approved and funds transferred to his account…all on the same day!

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

There are MANY reasons to choose your credit union over a bank, whether that’s to avail of lower interest, ethical loans, save into an instant access emergency fund or the desire to belong to a community of likeminded savers and borrowers.

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Do you know how much is remaining on your loan with us? Need some help with forthcoming holiday costs?

Need help financing a holiday, car, home improvement, credit card debt and more?

Do you have a child or more than one child heading off to college or university soon? Or perhaps you’re planning for this big event in one, two or three years’+ time. Are you ready for the financial investment which comes with your child studying away from home?

Our recent member survey shows that 27% of Harp & Crown CU members who BORROW do so for HOME IMPROVEMENT reasons!

But just how much could your HOME RENOVATIONS cost this year?

Would YOU and your colleagues/family love to JOIN Harp and Crown Credit Union?

There are MANY reasons to choose your credit union over a bank, whether that’s to avail of lower interest, ethical loans, save into an instant access emergency fund or the desire to belong to a community of likeminded savers and borrowers.

Thanks to Harp and Crown Credit Union member Jackie for this fantastic feedback, having registered and used our NEW-IMPROVED ONLINE BANKING facility!

Thanks to Harp and Crown Credit Union member Kenneth for this fantastic feedback, having registered and used our NEW-IMPROVED ONLINE BANKING facility!

Thanks to Harp and Crown Credit Union member Sam for this fantastic feedback, having registered and used our NEW-IMPROVED ONLINE BANKING facility!

As the end of 2024 fast approaches, it's time to start planning your dream holiday for 2025.

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Hands up who got caught out with the BANK’S “HEADLINE” loan rate…

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

In 2023, we paid out a total of £76,000 in LOAN INTEREST REBATE to our borrowers!

In the event of your death, your BENEFICIARY will take sole responsibility of your Harp and Crown Credit Union account.

There are MANY reasons to choose your credit union over a bank, whether that’s to avail of lower interest, ethical loans, save into an instant access emergency fund or the desire to belong to a community of likeminded savers and borrowers.

Need help with New Car/Car Repairs, Home Improvement, Engagement/Wedding or Holiday costs?

Need help financing a holiday, car, home improvement, credit card debt and more? And in an ethical, flexible and affordable way?

With “wedding season” and September ending soon, you may have already attended a family or friend’s wedding! Or perhaps you’re planning for a 2025 wedding?

Today is World Beard Day. At Harp and Crown, we recognise the dedication and care it takes to grow and maintain a significant beard, qualities that mirror our commitment to serving you with excellence!

Thanks to Harp and Crown Credit Union member Caron for this fantastic feedback, having registered and used our NEW-IMPROVED ONLINE BANKING facility!

August...you EXCEEDED our expectations! Thanks to our valued members for another positive month at Harp and Crown Credit Union!

Do you need to AMEND your monthly PAYROLL or DIRECT DEBIT savings amount? EASY!

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

There are MANY reasons to choose your credit union over a bank, whether that’s to avail of lower interest, ethical loans, save into an instant access emergency fund or the desire to belong to a community of likeminded savers and borrowers.

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

Happy Halloween from the HACCU team! Why not try our Loan Calculator today! We have scarily low loan interest rates on offer!

Are you RETIRING this year? Not sure what to do with your COMMUTATION payment?

Have YOU contacted us to ACTIVATE your NEW-improved ONLINE BANKING platform yet? NOW with an APP and FASTER PAYMENTS facility? AND a NEW user-friendly LOAN APPLICATION process?

Did you know we have a 1ST TIME LOAN with a fantastic low interest rate of 5.5% APR?

Whether you are an existing borrower or have never taken out a loan at Harp and Crown Credit Union…

Jim applied for a loan to change his car and his application was approved and funds transferred to his account…all on the same day!

.jpg)

A privilege to meet PSNI Student Officers this week at the NI Police College!

Why not SPREAD THE COST of your caravan site fees with our NEW FLEXI-LOAN!

Have YOU contacted us to ACTIVATE your NEW-improved ONLINE BANKING platform yet? NOW with an APP and FASTER PAYMENTS facility?

Need help financing a holiday, car, home improvement, credit card debt and more? And in an ethical, flexible and affordable way?

You could be missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR FINANCE?

"How can I make a LODGEMENT?” “AND what is the MAXIMUM deposit I can make per calendar month?”

Following Harp and Crown Credit Union’s 26th Annual General Meeting, we are delighted to confirm…

Why not SPREAD THE COST of your home insurance with our NEW FLEXI-LOAN!

Is your car insurance renewal due soon? You could be missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR FINANCE and INSURANCE COSTS.

Have YOU contacted us to ACTIVATE your NEW-improved ONLINE BANKING platform yet? NOW with an APP and FASTER PAYMENTS facility?

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Changing your car soon? Not sure whether to buy NEW, second hand or go down the HP or PCP route?

Is your junior learning to drive in the next couple of years? Here are the potential costs and how YOUR credit union could help.

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

Is your car insurance renewal due soon? You could be missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR FINANCE and INSURANCE COSTS.

Need help financing a holiday, car, home improvement, credit card debt and more? And in an ethical, flexible and affordable way?

Did you know some Payday loans are offering short term loans as high as 89% APR! Shocking!

With holiday and flight PRICES INCREASING there’s no better time to secure your getaway than now!

You may have never needed to take a loan out until this point. Given the recent storm damage to property and homes Ireland wide, please remember YOUR Credit Union is here to help in an ethical and flexible way. We are 'people helping people'.

Thanks to Harp & Crown Credit Union member Alan for this fantastic feedback, having used our NEW Flexi-Loan!

Thanks to Harp & Crown Credit Union member Colin for this fantastic feedback, having applied for our NEW Flexi-Loan!

Thanks to Harp & Crown Credit Union member Dorothy for this fantastic feedback, having used our NEW Flexi-Loan!

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

A gentle reminder...our next office closure is coming up soon - Monday 17th March 2025 (St Patrick's Day closure).

Have YOU contacted us to ACTIVATE your NEW-improved ONLINE BANKING platform yet?

NOW with an APP and FASTER PAYMENTS facility?

This Debt Awareness Week, we’re supporting debt help charity StepChange by raising awareness and understanding of the stigma around debt. “Debt happens. Let’s deal with it.”

.jpg)

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

Thanks to Harp & Crown Credit Union member Donald for this fantastic feedback, having used our NEW Flexi-Loan!

Thanks to Harp & Crown Credit Union member Hilary for this fantastic feedback, having used our NEW Flexi-Loan!

Did you know? Our NEW Flexi-Loan can be taken in addition to another HACCU loan? Ts/Cs apply.

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

With holiday and flight PRICES INCREASING there’s no better time to secure your getaway than now!

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

A gentle reminder... our next office closure is coming up soon - Monday 5th May 2025.

This Debt Awareness Week we want to emphasise this message as YOUR Credit Union.

In a Credit Union Galaxy not so far away, you can master the art of financial planning!

During the month of May, many HACCU members would have been availing of our Loan Promotion.

There are MANY reasons to choose your credit union over a bank, whether that’s to avail of lower interest, ethical loans, save into an instant access emergency fund or the desire to belong to a community of likeminded savers and borrowers.

During the month of May, many HACCU members would have been availing of our Loan Promotion.

Need to consolidate outstanding, high interest debt? invest in a new home or wedding? We are here to help.

Have YOU contacted us to ACTIVATE your NEW-improved ONLINE BANKING platform yet?

Are you missing out on LOWER INTEREST RATE LOANS? Especially when it comes to CAR PURCHASES and car finance?

.jpg)

Just one of our KEY BENEFITS at the Harp and Crown Credit Union, which differentiates us from banks and other credit unions!

Need to consolidate outstanding, high interest debt? invest in a new home or wedding? We are here to help.

Need help with a new car or car repairs? Home improvement? University fees? Or more?

For all of us in the Northern Hemisphere, the Summer Solstice occurs on the 21st June 2025.

Have YOU contacted us to ACTIVATE your NEW-improved ONLINE BANKING platform yet? NOW with an APP and FASTER PAYMENTS facility?

You could apply for a Flexi-Loan IN ADDITION to an existing HACCU loan. *Ts/Cs apply.

A gentle reminder... our next office closure is coming up soon - Monday 14th and Tuesday 15th July 2025.

A gentle reminder... our next office closure is coming up soon - Monday 14th and Tuesday 15th July 2025.

A gentle reminder... our office is closed on Monday 14th and Tuesday 15th July!

Did you know you can apply for the Flexi-Loan directly through our online app?

Our recent member survey shows that 21% of Harp & Crown CU members who BORROW do so for HOME IMPROVEMENT reasons!

In 2024, we paid out a DIVIDEND of over £1 MILLION to Harp & Crown Credit Union members!

Need help with a new car or car repairs? Home improvement? Engagement/wedding? Holiday? Or more?

Did you know? Our NEW Flexi-Loan can be taken in addition to another HACCU loan? Ts/Cs apply.

Have you REMARRIED? Has your BENEFICIARY passed away? OR have your personal circumstances changed since you opened your HACCU account?

Thank you to everyone who applied for our NEW Flexi-Loan and took part in the prize draw!

Need help financing a holiday, car, home improvement, credit card debt and more? And in an ethical, flexible and affordable way?

Thanks to Harp and Crown CU member Cathy for this fantastic feedback, having contacted for a loan top up which was approved and funds transferred to her account…all on the same day!